INCOME-BASED VALUATION

- Calculates the present value of projected future income flow (i.e. 'ability to generate cash flow') of an IP asset during its expected economic life.

- The economic life of the intellectual property, or the period during which the intellectual property can be expected to afford its owner an economic benefit, is not the same as legal life.

- The major disadvantage is that, for a new technology, there are generally no sales, markets, or cost data that can be used to predict future revenues.

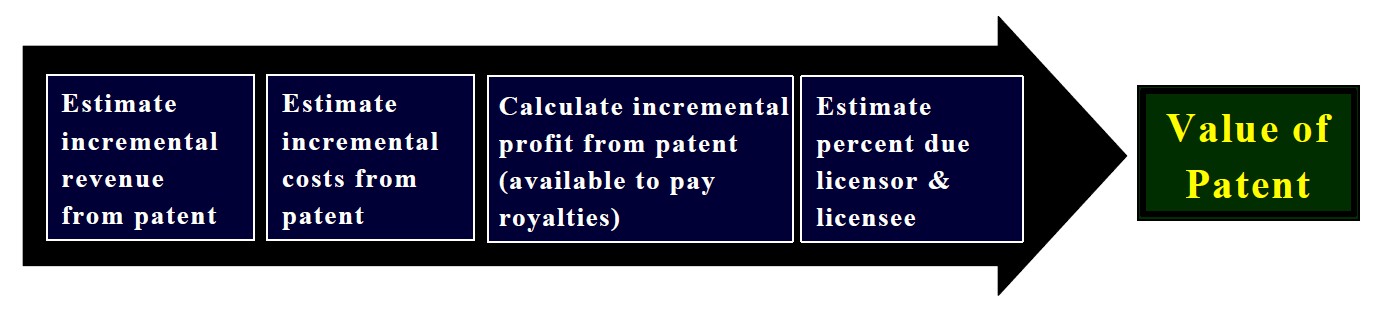

Direct Cash Flow Method

- Utilizes the cash flows directly attributable to the subject asset.

- A condition for this is that the cash flows can be measured directly. This will especially be the case if the technology is not used in production processes by the owner himself but is made available to third parties by licensing.

- The license fees can be used directly as cash flows in the valuation calculation (mp3s for example, are 100% license based)

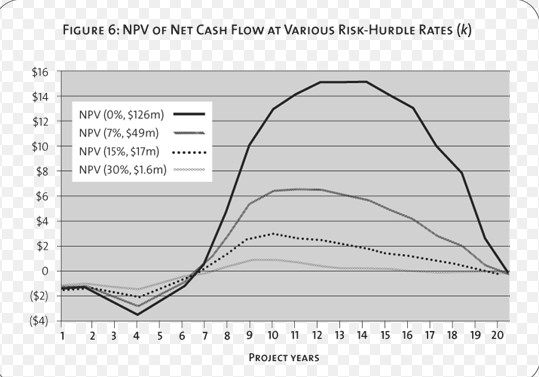

Discounted Cash-Flow Method

- Projects future expected income flow and converts it to a net present value by applying an appropriate discount rate.

- “Discounted” by the time value of the money and risk.

- Discount rates include risk--effected by inflation, liquidity, etc.

- Determination of the Net Present Value of the IP asset.

- Projection of the future royalty stream (instead of “net cash flow”), discounted for the risk and money value over time.

Excess Profit Method

- Uses the value of the net tangible asset to calculate the rate of return and, in doing so, estimates the potential value of the IP.

- Calculates the projected Net Tangible Asset (NTA) of the company possessing the IP.

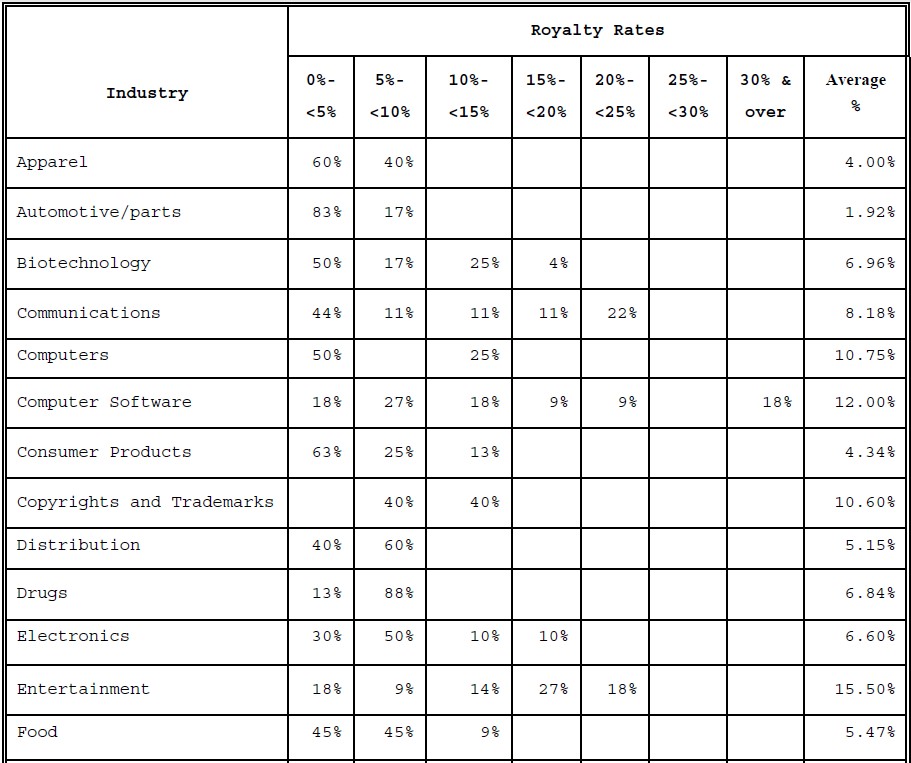

Relief-from-Royalty Method

Valuing intangible assets by their estimated annual royalties gained under licensing arrangements.

Assumes the value of an IP asset can be measured by the amount of royalties received under a licensing agreement. The challenge is to select an appropriate royalty rate.

A major disadvantage is that a royalty rate can be assumed, BUT in reality it may never materialiZe.