IP Valuation:

The process of identifying and measuring benefit and risk from an intangible asset.

IP Valuation is an ESTIMATION of an intangible asset value, not a precise figure.

IP Valuation depends on:

- Use of the IP assets

- Market share of company

- Openness of economy

- Legal protection of IP

- Enforcement cost

- Economic growth

- Profile of economy

IP Valuation is utilized for:

- Commercial transactions

- Pricing product

- Evaluating potential merger or acquisition candidates

- Identifying and prioritizing assets that drive value

- Strengthening positions in technology transfer negotiations

- Making informed financial decisions on IP maintenance, commercialization and donation

- Evaluating the commercial prospects for early stage Research & Development (R&D)

- Evaluating R&D efforts and prioritizing research projects

- Financing securitization

- Litigation

- Tax planning

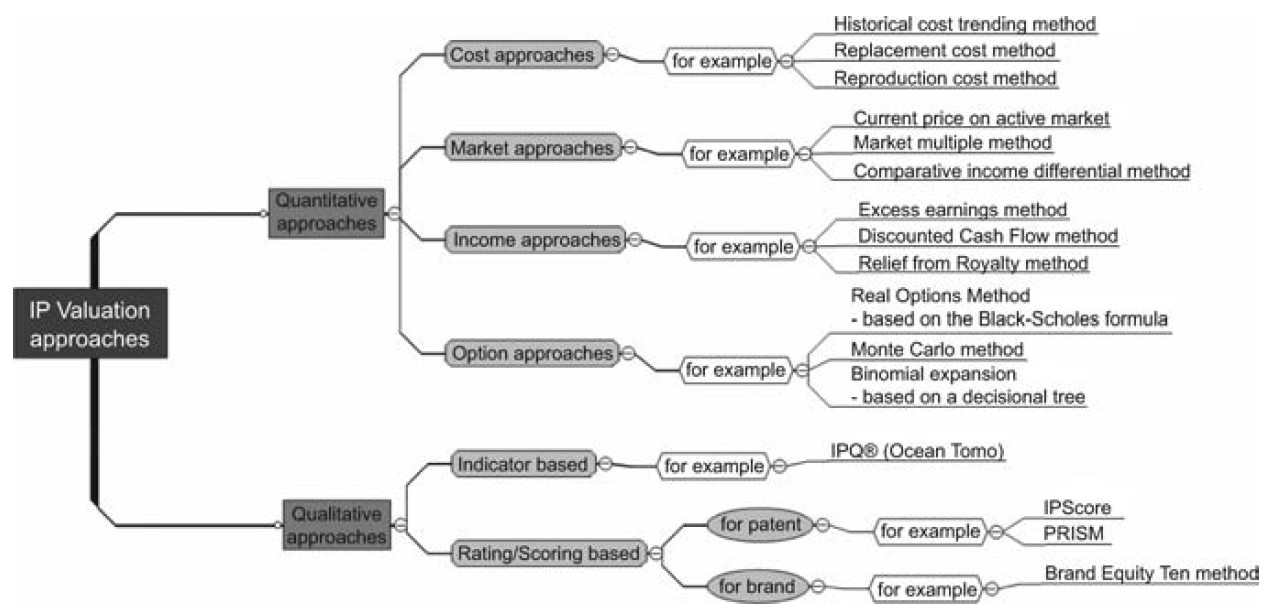

IP Valuation Methods